Pricing impact of COVID-19 likely ‘dramatic’: MarketScout

Posted On: Apr. 6, 2020 2:23 PM CSTU.S. commercial property/casualty insurance rates were mostly stable in the first quarter of 2020, but COVID-19 will have a ‘dramatic’ impact on prices going forward, online insurance exchange MarketScout Corp. said Monday.

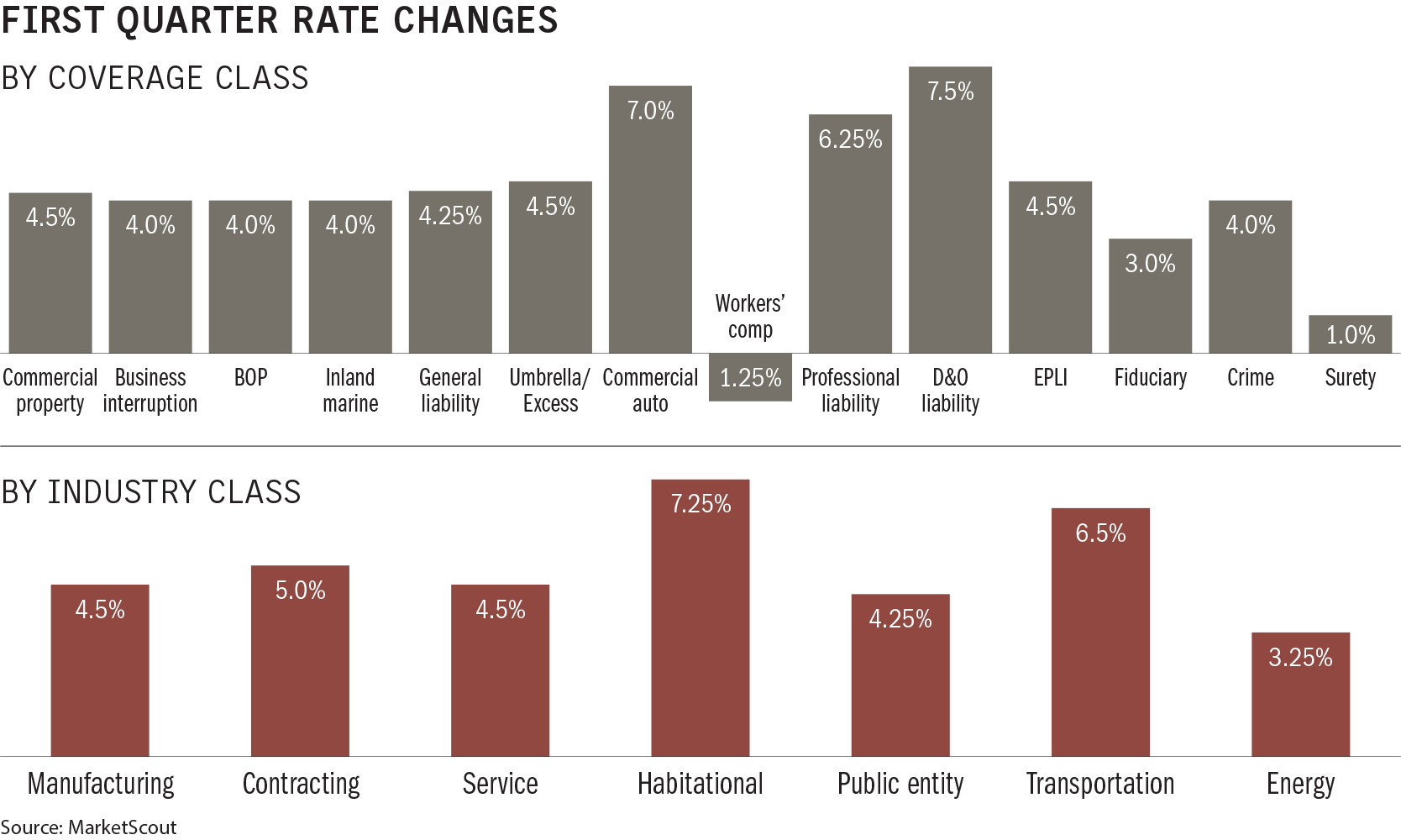

Average rate increases for commercial insurance buyers in the U.S. were 4.5% in the first quarter, down from 5% in the last quarter of 2019, MarketScout said in a statement.

The pricing impact of COVID-19 will be borne out in the second, third and fourth quarter of 2020, according to Richard Kerr, CEO of MarketScout.

“Lower exposure base and the possibility of governmental intervention in coverage application will have a dramatic impact on the pricing for the rest of the year,” Mr. Kerr said in the statement.

D&O liability rates increased by 7.5%, while commercial auto increased 7% in the quarter, and professional liability rates were up 6.25%, according to MarketScout.

CLICK IMAGE TO ENLARGE

Commercial property, employment practices liability and umbrella/excess insurance rates increased 4.5% in the quarter, while general liability rates were up 4.25%, and business interruption, business owners policies, inland marine, and crime were up 4.0%, MarketScout said.

All other lines showed smaller increases, except for workers compensation, where rates fell 1.25%, MarketScout said.

By industry class, habitational and transportation saw the highest average rate increases at 7.25% and 6.5%, respectively, MarketScout said.

Jumbo accounts – those with more than $1 million in premium – saw a rate hike of 5.5% in the first quarter. Large accounts, those with $250,001 to $1 million in premium, and small accounts, up to $25,000 in premiums, were up 4.5%. Medium accounts, which have $25,001 to $250,000 in premium, were up 4.25%, MarketScout said.

More insurance and risk management news on the coronavirus crisis here.